Addy AI

About Addy AI

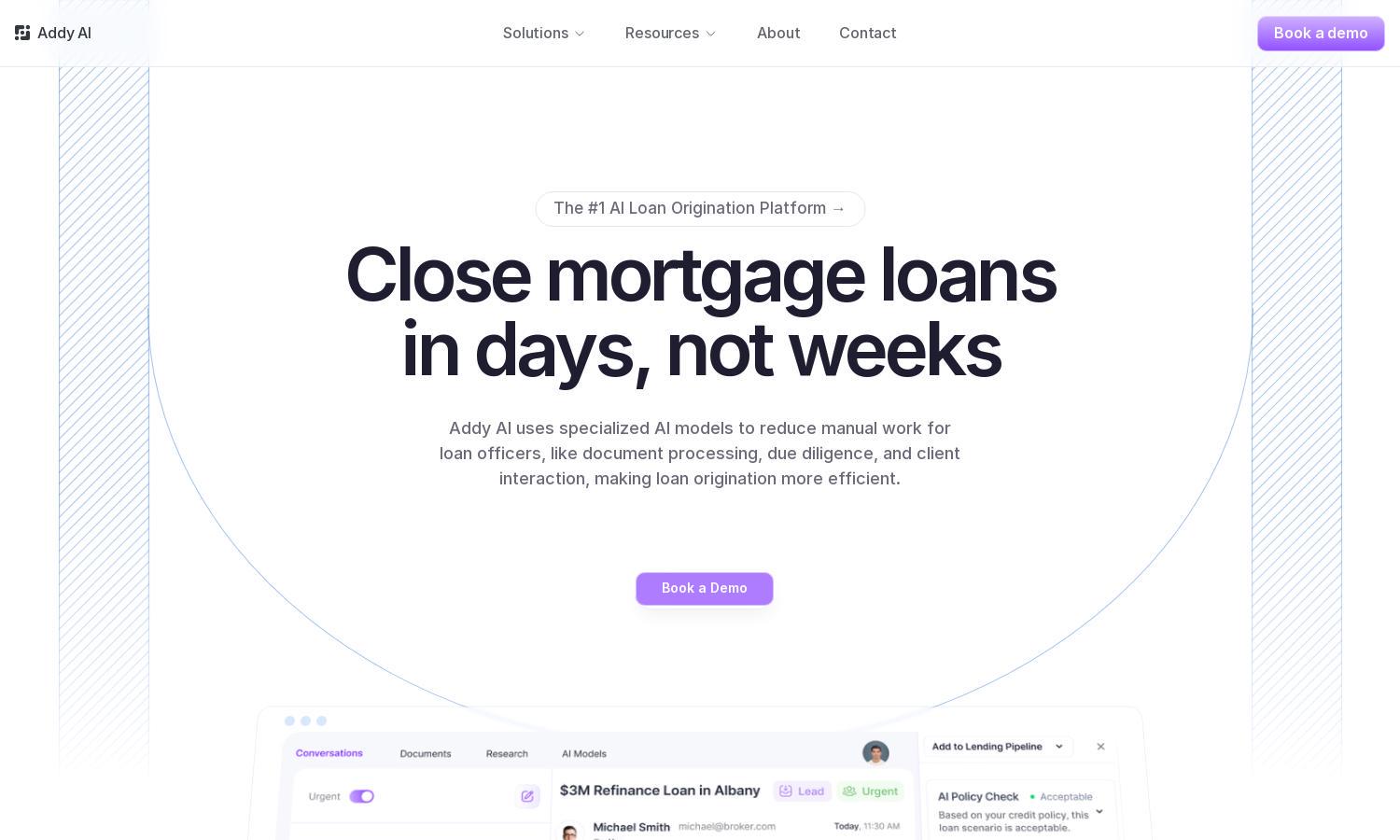

Addy AI is designed for mortgage lenders aiming to streamline their loan origination process. By utilizing specialized AI models, the platform automates critical tasks, reduces manual work, and enhances efficiency. User-friendly and innovative, Addy AI helps lenders close loans faster and improves overall client satisfaction.

Addy AI offers flexible pricing plans tailored to various lender needs, providing value at every tier. Users can explore special discounts with upgrades, unlocking enhanced features that optimize loan processing. Investing in higher tiers enables access to advanced AI functionalities, driving efficiency and maximizing mortgage origination success.

The user interface of Addy AI is designed for optimal ease of use and seamless navigation. The clean and intuitive layout allows users to interact with AI tools effortlessly. Unique features enhance the browsing experience, enabling users to automate tasks without additional complexity, maximizing efficiency in loan processing.

How Addy AI works

Users begin with onboarding on Addy AI by creating an account and integrating their existing systems. Once set up, they can train customized AI models to automate loan processing tasks, like document handling and client follow-ups. The platform's intuitive interface guides users through essential features, ensuring a smooth experience that significantly reduces manual workload.

Key Features for Addy AI

AI-Driven Loan Origination

Addy AI's key feature is its AI-driven loan origination process. This innovative functionality automates crucial tasks, allowing mortgage lenders to close loans in days rather than weeks. By reducing manual effort and enhancing efficiency, Addy AI maximizes the productivity of loan officers and improves client service.

Instant Loan Assessments

Instant loan assessments are crucial to Addy AI's functionality. This feature allows mortgage lenders to quickly evaluate loan applications against credit policies, providing immediate feedback and suggestions for ineligibility. This speeds up the decision-making process and helps lenders maintain a competitive edge in the fast-paced lending market.

CRM Integration

Addy AI's seamless CRM integration is a standout feature that enhances workflow efficiency. By automatically syncing and updating loan data, lenders can streamline their operations, reduce context-switching, and ensure timely follow-ups with clients. This integration leads to improved productivity and satisfaction for both lenders and borrowers.

You may also like: