finbots.ai

About finbots.ai

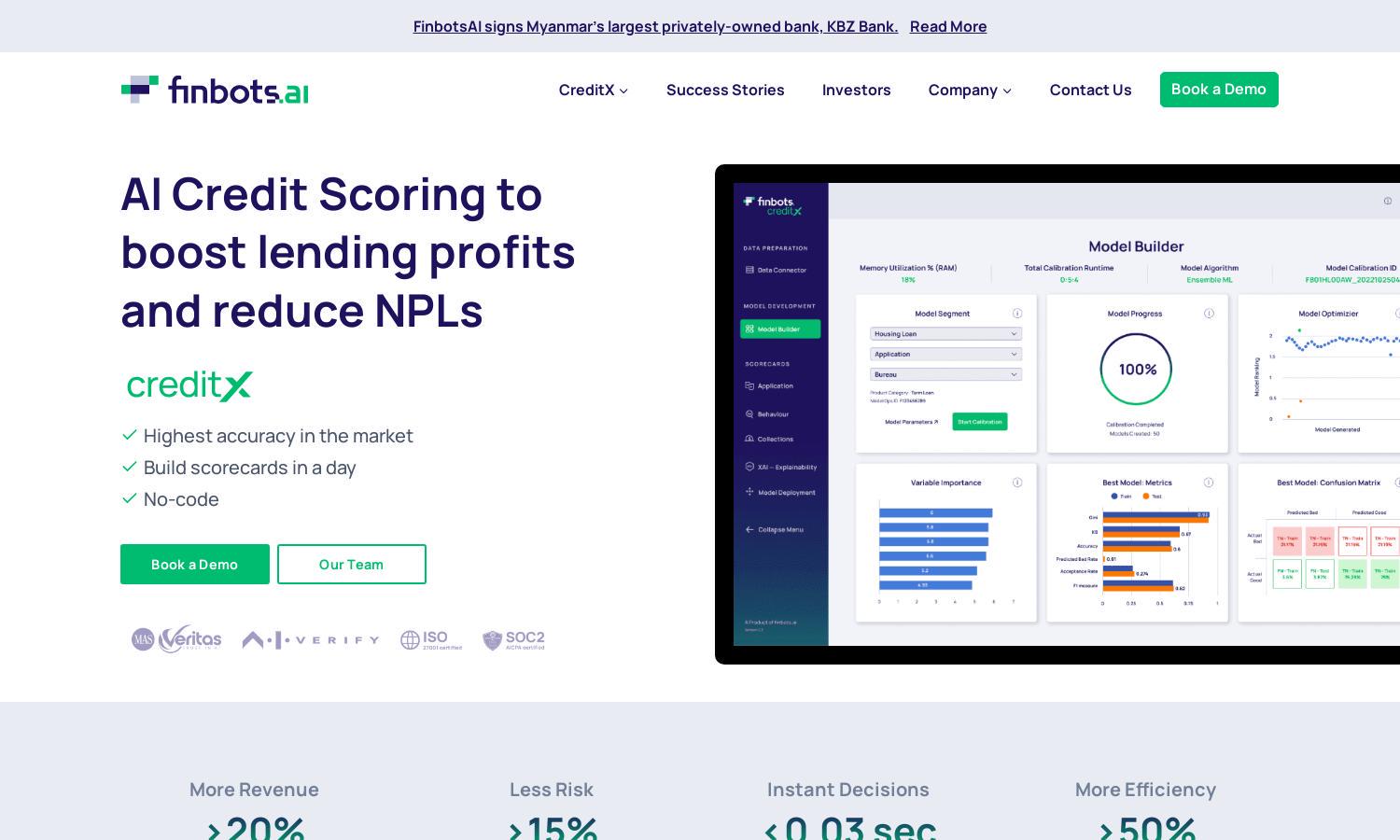

Finbots.ai is an AI-driven credit risk platform aimed at optimizing lending processes for banks and financial institutions. With its innovative CreditX solution, users can build accurate credit scorecards rapidly, ensuring real-time decision-making and enhanced profitability. This technology reduces non-performing loans while promoting better customer service.

Finbots.ai offers flexible pricing plans for its CreditX platform, providing scalable solutions tailored to diverse lending institutions. Users can benefit from significant discounts during the first six months. Upgrading to premium tiers allows access to advanced features, fostering improved loan approval rates and reduced operational costs.

Finbots.ai boasts a sleek, user-friendly interface designed to streamline the lending process. Its layout allows for easy navigation among features, promoting a seamless experience. With its intuitive design, users can quickly access valuable insights and tools, ensuring efficient credit risk management and enhanced decision-making capabilities.

How finbots.ai works

Users can start with finbots.ai by quickly signing up and onboarding their data into the CreditX platform. Once their data is connected, they can effortlessly build custom credit scorecards using the automated tools provided. The platform allows quick validation and deployment, enabling users to make instant lending decisions, significantly improving efficiency.

Key Features for finbots.ai

Custom Scorecards

Finbots.ai offers powerful custom scorecards that are AI-generated, enabling users to adapt quickly to changing market conditions. This unique feature allows lending institutions to deploy high-accuracy credit assessments in record time, significantly enhancing their risk management capabilities while reducing non-performing loans.

Real-Time Decisioning

The real-time decisioning feature of finbots.ai empowers lenders to make immediate credit decisions, reducing turnaround times to less than 0.03 seconds. This capability enhances the customer experience and accelerates the lending process, allowing businesses to profitably respond to loan applications quickly and efficiently.

Automated Data Validation

Finbots.ai features robust automated data validation processes that ensure high data integrity and compliance. By automatically validating data from various sources, it reduces manual errors and accelerates the credit scoring process, further supporting lenders in making informed decisions while maintaining regulatory standards.