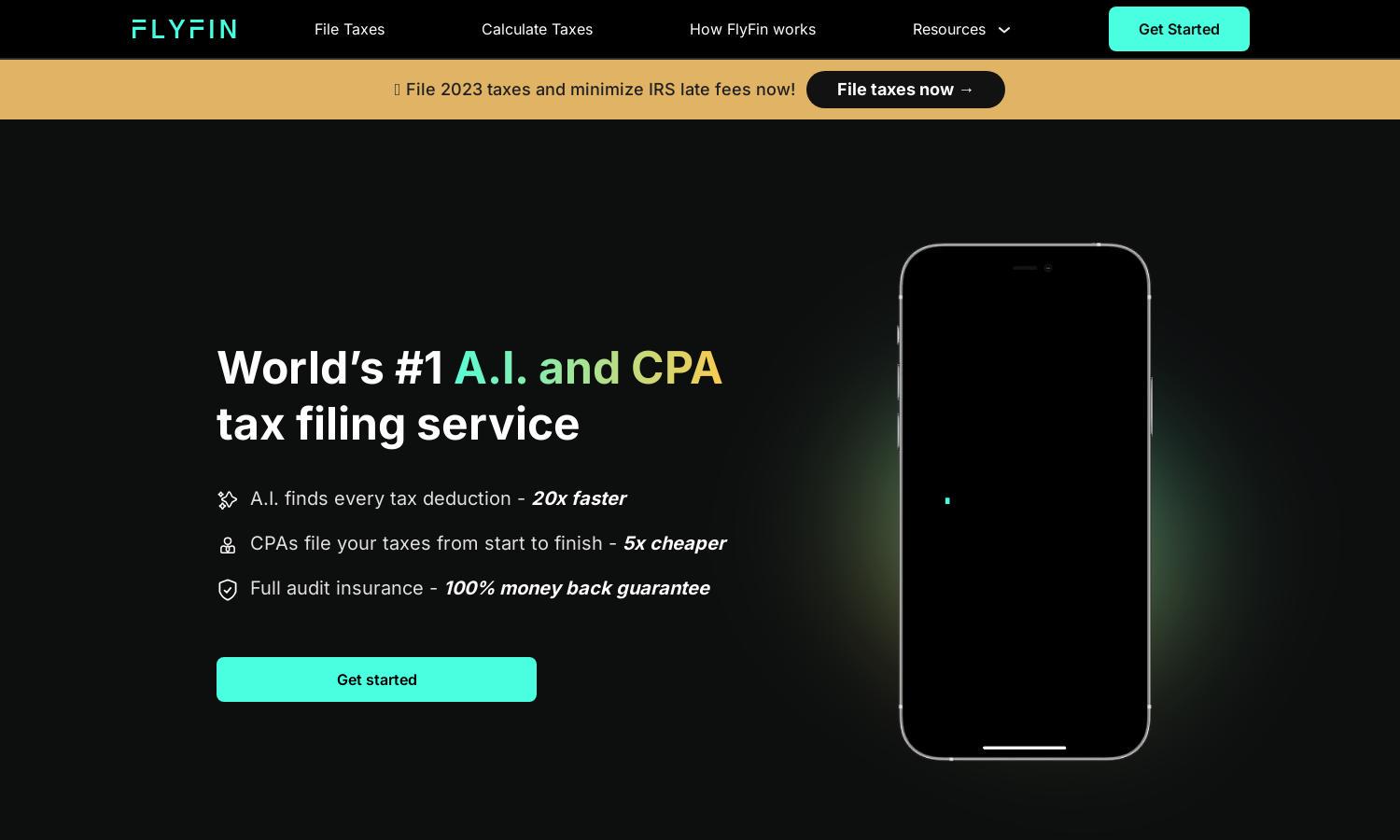

FlyFin

About FlyFin

FlyFin is the premier A.I. and CPA tax filing service tailored for freelancers and the self-employed. It streamlines tax filing by utilizing A.I. to maximize deductions while ensuring a dedicated CPA prepares your returns, making the process efficient, cost-effective, and hassle-free for users.

FlyFin offers tiered pricing for its tax filing services, tailored for various user needs. Each subscription provides access to expert CPA assistance and A.I. features, with potential discounts for new users. Upgrading enhances service value, ensuring comprehensive tax solutions for every freelancer.

The FlyFin interface is user-friendly, designed for seamless navigation and effective tax management. Its layout simplifies document uploads and communication with CPAs while unique features enhance the overall user experience. This makes tax filing straightforward, ensuring that freelancers efficiently manage their tax obligations.

How FlyFin works

Users start by easily onboarding with FlyFin through a quick setup that guides them in linking their expense accounts. The A.I. scans their financial data to find potential deductions. After uploading relevant documents, expert CPAs customize tax returns from start to finish, ensuring accuracy and maximum refunds, ultimately simplifying the entire tax filing process.

Key Features for FlyFin

A.I. Deduction Tracker

FlyFin's A.I. Deduction Tracker is a standout feature that scans expenses to find every eligible tax deduction. This innovative tool significantly reduces the workload for freelancers, ensuring no deduction is overlooked and maximizing potential refunds, thus adding remarkable value for users.

Quarterly Tax Calculator

The Quarterly Tax Calculator from FlyFin offers freelancers an accurate way to estimate their tax obligations based on real-time income and deductions. This feature enhances financial planning, helping users avoid surprises at tax time and ensuring timely payments to the IRS.

Full Audit Insurance

FlyFin provides Full Audit Insurance, a unique offering that protects users in case of an IRS audit. With dedicated CPAs handling communications and responses, freelancers can file their taxes confidently, knowing they have expert support to navigate any audit challenges effectively.

You may also like: