TaxGPT

About TaxGPT

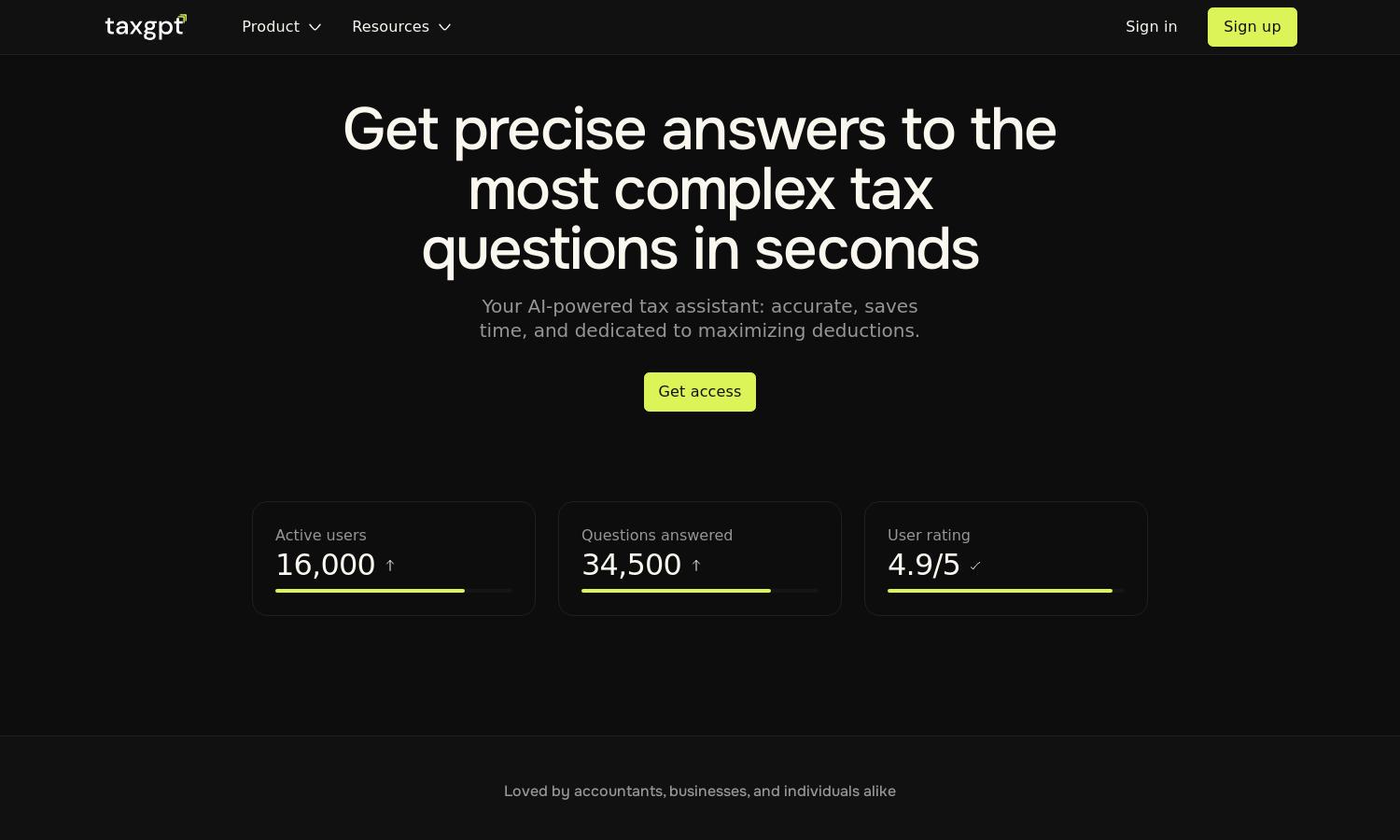

TaxGPT serves as an innovative AI tax assistant for accountants, significantly improving productivity and accuracy. Users experience streamlined tax processes, quick responses to complex queries, and a user-friendly interface. This secure platform empowers tax professionals to manage tasks efficiently while maximizing deductions for clients.

TaxGPT offers flexible pricing plans, including a free 14-day trial, enabling users to explore its powerful features. Subscription tiers provide varying access levels, enhancing tax research and document management. Upgrading unlocks additional benefits like priority support and advanced tools, making TaxGPT invaluable for tax professionals.

TaxGPT boasts a sleek, user-friendly interface designed for seamless navigation. Its intuitive layout ensures that users can easily access vital features such as tax document support and client management. This focus on user experience makes TaxGPT a preferred choice among tax professionals looking for efficiency.

How TaxGPT works

Users begin their journey with TaxGPT by signing up and completing a quick onboarding process. Once registered, they can seamlessly navigate the platform, leveraging AI-powered tools to get instant answers to tax-related queries, create tax memos, and manage client interactions. The system's design facilitates efficient workflow enhancements and maximizes productivity throughout tax processes.

Key Features for TaxGPT

AI Tax Co-Pilot

TaxGPT's AI Tax Co-Pilot feature transforms the way tax professionals handle research and documentation. By utilizing advanced algorithms, TaxGPT provides accurate answers and insights, saving users significant time and effort in tax processes, maximizing productivity, and enabling informed decision-making.

Secure Data Handling

TaxGPT prioritizes user security with robust data handling practices. All sensitive information is encrypted and confidential, ensuring that professionals can rely on the platform without compromising client privacy. This level of security distinguishes TaxGPT in the competitive landscape of tax assistance.

Instant Tax Answers

The Instant Tax Answers feature of TaxGPT revolutionizes client interactions by providing immediate responses to complex tax questions. Users can use this tool to enhance communication, improve client satisfaction, and minimize the time spent on manual research, making TaxGPT an essential asset for tax professionals.