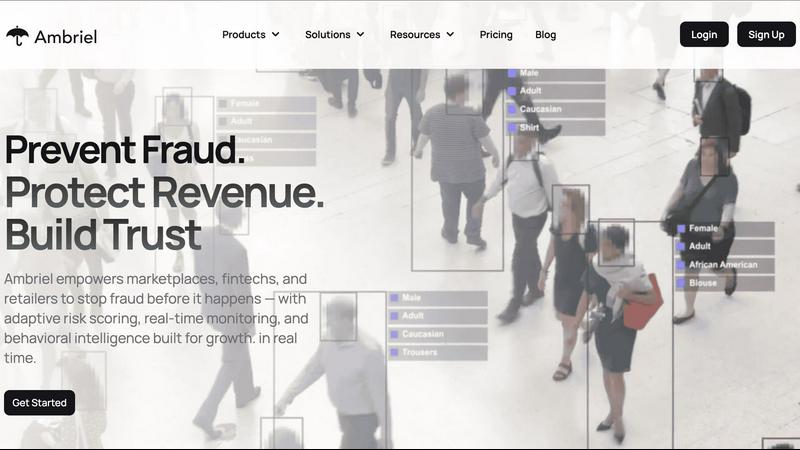

Ambriel

Ambriel is a sophisticated risk engine that detects and prevents fraud in real time to protect revenue.

Visit

About Ambriel

Ambriel is an advanced fraud intelligence and risk management platform engineered for the digital age. It empowers forward-thinking businesses to operate with unparalleled security and regulatory confidence while preserving a seamless experience for their genuine users. Designed specifically for the complex demands of fintech, marketplaces, retailers, and iGaming platforms, Ambriel synthesizes a multitude of sophisticated signals—from behavioral analytics and device intelligence to real-time sanctions screening—into a single, cohesive ecosystem. Its core value proposition lies in its proactive ability to detect, score, and prevent fraud before it can inflict damage on revenue or reputation. By analyzing transactions, user behaviors, and network patterns, Ambriel uncovers hidden risk and automates mitigation, transforming security from a reactive cost center into a strategic asset that builds enduring customer trust.

Features of Ambriel

AI-Driven Risk Scoring Engine

At the heart of Ambriel lies a powerful, AI-driven risk scoring engine that analyzes data from over 200 global sources. This sophisticated system evaluates each transaction, login, and user action in real-time, assigning a dynamic risk score. This allows businesses to make instant, data-informed decisions, automatically blocking high-risk activity while allowing legitimate interactions to proceed without friction, thereby protecting revenue proactively.

Automated Sanctions & PEP Screening

Ambriel ensures rigorous compliance with minimal operational overhead through its automated global screening. The platform continuously checks users and transactions against more than 100 constantly updated sanctions lists, Politically Exposed Persons (PEP) registers, and crime databases. This eliminates the need for error-prone manual reviews, streamlining compliance for anti-money laundering (AML) and Know Your Customer (KYC) regulations.

Continuous Behavioral Monitoring

Security is not a moment-in-time check but a continuous process. Ambriel provides 24/7 surveillance of accounts and transaction streams, employing behavioral analytics to establish individual user baselines. The system instantly flags anomalies—such as unusual login locations, atypical spending patterns, or sudden changes in device—enabling teams to intervene before suspicious activity escalates into a confirmed fraud case.

Customizable Onboarding & Case Management

Ambriel offers a flexible framework to tailor the user journey. Businesses can design seamless onboarding flows with integrated, automated trust checks to welcome only verified customers. Furthermore, the platform includes a centralized case management dashboard where security teams can review alerts, orchestrate investigations, and manage mitigation actions efficiently, all within a single interface.

Use Cases of Ambriel

Onboarding and Synthetic Identity Fraud Prevention

During user registration, Ambriel scrutinizes every sign-up to detect and block fake accounts and synthetically constructed identities. By analyzing device fingerprints, network signals, and behavioral cues, it prevents bot-driven signups and fraudulent profiles from ever gaining a foothold on the platform, securing the ecosystem from its first point of entry.

Real-Time Payment and Transaction Fraud Mitigation

Ambriel monitors every payment event as it happens, identifying anomalous transactions that may indicate stolen payment details or fraudulent transfers. This real-time analysis helps prevent chargebacks and direct financial loss by allowing businesses to block suspicious payments before they are processed, safeguarding the bottom line.

Bonus and Promotion Abuse Detection

For businesses running incentive programs, Ambriel is essential for ensuring fairness and ROI. It expertly identifies multi-accounting, coordinated referral scams, and other schemes designed to exploit promotional offers and bonuses. This protects marketing spend and ensures rewards reach only legitimate, valuable customers.

Account Takeover and Credential Stuffing Defense

Ambriel protects user accounts by identifying compromised login attempts. It detects signals of credential stuffing attacks, unusual login behavior, and suspicious device changes. By flagging these attempts, it enables immediate protective actions like step-up authentication, preventing unauthorized access and preserving customer security and trust.

Frequently Asked Questions

What industries is Ambriel best suited for?

Ambriel is specifically engineered for digital-native businesses operating in high-risk, high-volume environments. Its primary adopters include financial technology (fintech) companies, digital marketplaces, e-commerce retailers, iGaming platforms, insurance providers, and cryptocurrency exchanges. Any business that requires robust fraud prevention coupled with stringent regulatory compliance will find Ambriel's ecosystem powerful and adaptable.

How does Ambriel balance security with user experience?

Ambriel is built on the principle of invisible security. Its AI-driven risk engine makes precise, real-time decisions, allowing the vast majority of legitimate user activity to proceed completely uninterrupted. By automating checks and only introducing friction (like additional verification) when risk is genuinely elevated, it creates a secure yet exceptionally smooth journey for trusted customers.

Does Ambriel help with regulatory compliance?

Absolutely. Ambriel is a cornerstone for compliance programs. Its automated sanctions, PEP, and adverse media screening directly address AML and KYC requirements. Furthermore, the platform is designed with compliance in mind, adhering to standards like GDPR, and provides the audit trails and reporting necessary to demonstrate due diligence to regulators.

How quickly can Ambriel be integrated into our existing systems?

Ambriel offers a streamlined integration process with comprehensive documentation and developer support. The platform provides flexible APIs and pre-built connectors for major commerce platforms like Magento, WooCommerce, and Wix Commerce, enabling businesses to deploy core fraud prevention capabilities rapidly and start protecting their revenue without lengthy development cycles.

You may also like:

Crowdstake AI

Crowdstake is an AI-powered web and marketing system that helps founders and teams launch beautiful, high-conversion websites.

apptovid

AI powered Promotional Video Maker that can directly turn URL to Video for apps

CIOOffice: the CIO-Software

CIOOffice is a centralized cloud platform for CIOs to manage IT strategy, budgets, projects, and vendor relationships...