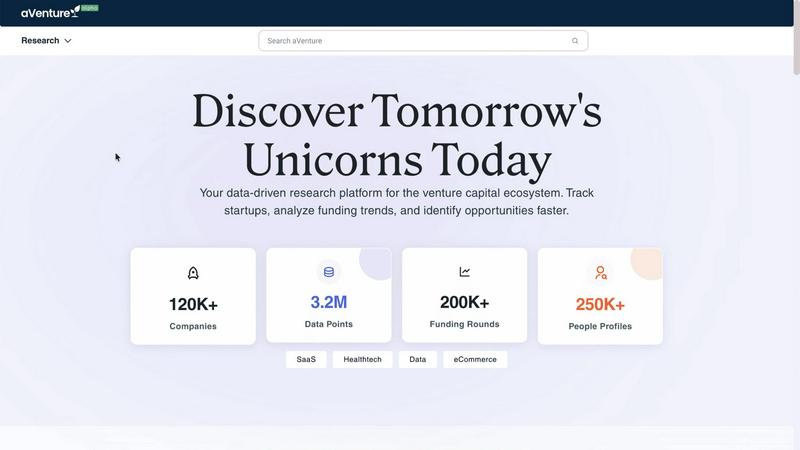

aVenture

aVenture delivers institutional-grade venture intelligence to research private companies and map the competitive land...

Visit

About aVenture

aVenture is the definitive intelligence platform for the private markets, engineered for professionals who demand precision and foresight. It transforms the complex, fragmented landscape of venture capital and startup data into a clear, actionable strategic asset. The platform provides institutional-grade access to a dynamic database of over 109,000 venture-backed companies, tracking $12.7 trillion in total funding across 132 countries. Beyond mere aggregation, aVenture deploys a sophisticated AI analyst to synthesize the latest news and coverage, delivering concise summaries that highlight genuine traction, pinpoint potential risks, and interpret how emerging events may impact a company's trajectory. Designed for the discerning user, it empowers founders, investors, and operators to move beyond data collection to genuine insight, enabling confident decision-making in fundraising, due diligence, competitive analysis, and partnership development.

Features of aVenture

Deep Company Insights

Navigate beyond surface-level data with comprehensive profiles detailing ownership structures, complete funding histories, competitive positioning, and key personnel. This feature provides the granular, verified intelligence that institutional investors rely on for thorough due diligence and accurate market mapping across the entire private company ecosystem.

AI-Powered Signal Tracking

Our proprietary AI analyst continuously monitors over 1,200 data sources, distilling vast amounts of news and information into concise, material updates. It filters out the noise to surface only the most relevant developments, providing summaries on traction, risks, and event implications to keep you informed on what truly matters.

Advanced Investor Mapping

Gain a strategic understanding of investment landscapes by exploring every company a specific investor has backed. Filter portfolios by sector, stage, and geography to identify patterns, build highly targeted outreach lists, and understand the strategic focus of leading venture capital firms and angel investors.

Collaborative Workspace Tools

Streamline team-based research with powerful organizational capabilities. Save custom company lists, annotate profiles with private notes, export structured data for external analysis, and seamlessly share curated research with colleagues, ensuring alignment and efficiency across all stakeholders.

Use Cases of aVenture

Founder Fundraising Preparation

Founders leverage aVenture to identify and research the most relevant investors for their stage and sector, understand recent investment theses, and refine their pitch by analyzing look-alike companies. This ensures targeted, informed outreach and strengthens positioning during critical fundraising conversations.

Venture Capital Due Diligence

Investment analysts and associates use the platform to conduct deep diligence on potential deals. They examine a target company's full cap table, funding history, competitive landscape, and recent news signals to assess viability, uncover risks, and validate growth narratives with concrete data.

Business Development & Partnership Scouting

BD and sales teams utilize aVenture to scout for potential partners, customers, or acquisition targets. By tracking companies within specific verticals, growth stages, or geographic clusters, they can build qualified lead lists and understand a prospect's business context before initial contact.

Competitive Landscape Monitoring

Operators and strategists track their direct and adjacent competitors in real-time. By following companies and themes, they receive alerts on new funding rounds, product launches, leadership changes, and press coverage, allowing for proactive strategic adjustments.

Frequently Asked Questions

What is the source of aVenture's data?

aVenture aggregates and verifies data from a comprehensive network of over 1,200 primary sources, including regulatory filings, news publications, company websites, and direct partnerships. Our platform continuously updates this information, maintaining a live database of over 12.8 million data points to ensure accuracy and timeliness.

How does the AI analyst work?

The AI analyst is an advanced natural language processing system that scans the latest coverage and news for tracked companies. It identifies key events, extracts salient points, and generates succinct summaries that contextualize information—explaining whether an event signals traction, highlights a risk, or indicates a strategic shift.

Can I export data from the platform?

Yes, aVenture's workspace tools include robust export functionality. Users can export structured data from company profiles, saved lists, and search results into standard formats like CSV for further analysis in spreadsheets, presentation tools, or other business intelligence systems.

Who is the typical aVenture user?

aVenture is designed for sophisticated professionals in the venture ecosystem. Primary users include venture capital and private equity analysts, founders and startup executives, corporate business development teams, investment bankers, and any operator requiring deep, actionable intelligence on private companies and market trends.

You may also like:

finban

Plan your liquidity so you can make decisions with confidence: hiring, taxes, projects, investments. Get started quickly, without Excel chaos.

Zignt

Zignt simplifies contract management with secure templates, swift signing, and automated reminders for seamless colla...

iGPT

iGPT provides secure, intelligent email context for enterprise AI agents and workflows.