Poach

Poach expands venture capital dealflow by tracking competitor activity for early founder identification.

Visit

About Poach

Poach is a sophisticated intelligence platform designed to transform how venture capital firms and angel investors discover and engage with the next generation of founders. In the competitive landscape of early-stage investing, the highest-quality deals are often secured through privileged, early signals. Poach operationalizes this advantage by systematically tracking the social media activity of top-tier venture capitalists, primarily on Twitter (X), to identify the individuals they follow. This curated list serves as a powerful, pre-vetted signal of emerging talent and nascent ventures. The platform then enriches this raw data through LinkedIn integration and advanced AI analysis, delivering a comprehensive, actionable dataset directly to investors' inboxes. By providing a daily feed of enriched profiles—complete with professional labels, biographies, and contact links—Poach offers a signal quality that elegantly bridges the gap between a serendipitous warm introduction and inefficient cold outreach. It is engineered for the discerning investor who seeks to identify and connect with promising founders long before they formally enter a fundraising process, thereby securing a decisive and proprietary edge in dealflow.

Features of Poach

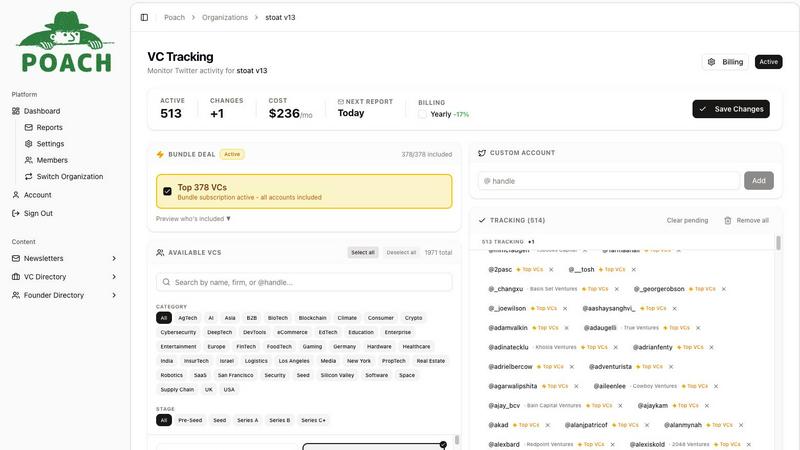

VC Social Tracking

Poach's core engine continuously monitors the Twitter follows of a curated list of prominent venture capitalists. This activity is a critical, non-public signal, as VCs often follow founders and technical talent they find intriguing long before an investment is announced. The platform captures this early interest, transforming passive social gestures into a structured, actionable stream of high-potential leads for its users, providing a window into the private deal-sourcing patterns of the industry's most influential players.

Identity Resolution & Enrichment

To transform a Twitter handle into a viable lead, Poach employs proprietary identity resolution technology to accurately match social profiles with corresponding LinkedIn accounts. This process enriches each record with verified professional history, educational background, and current role. The result is a complete professional dossier, moving beyond mere online presence to deliver the contextual depth necessary for informed investment sourcing and initial outreach.

AI-Powered Professional Labeling

Leveraging advanced artificial intelligence, Poach analyzes the combined data from Twitter bios and LinkedIn profiles to automatically assign professional labels to each individual. These labels—such as "founder," "engineering," "product," "funded," or "research"—allow for immediate and precise segmentation. This intelligent categorization enables investors to instantly filter for their specific thesis, such as identifying unfunded technical founders or researchers transitioning to entrepreneurship.

Raw Data Delivery & Export

Poach empowers users with full access to the underlying data. Each morning, subscribers receive an executive summary email alongside a comprehensive CSV export containing all tracked individuals, their enriched profiles, assigned labels, and which VC provided the signal. This raw data delivery allows for complete flexibility; users can import the CSV into their own CRM, apply custom filters, and conduct further analysis on their terms, integrating Poach's signal seamlessly into their existing workflow.

Use Cases of Poach

Proactive Founder Sourcing for Early-Stage VCs

Seed and Series A-focused venture firms can use Poach to systematically identify founders operating in stealth or pre-seed stages. By filtering for the "founder" label while excluding the "funded" label, investors can build a pipeline of entrepreneurs who are actively building but have not yet begun a formal capital raise. This enables proactive, context-rich outreach that positions the VC as a perceptive and engaged partner from the very inception of the company.

Thesis-Driven Talent Scouting

Investors with a specific focus—such as AI, climate tech, or web3—can leverage Poach's labeling system to scout for individuals with relevant expertise before they formally found a company. For instance, tracking leading AI research scientists ("research" label) who are being followed by top-tier VCs can signal an impending transition into entrepreneurship, allowing an investor to engage at the precise moment of career evolution.

Competitive Intelligence and Market Mapping

Investment teams can utilize Poach to monitor which emerging founders and technical leaders are capturing the attention of competing firms. Observing which individuals are followed by partners at rival venture funds provides invaluable competitive intelligence, helping to validate market trends, identify rising stars, and understand the strategic interests of other players in the ecosystem.

Enhancing Angel Investment Sourcing

Angel investors, who may lack the formal dealflow of institutional firms, can use Poach to gain access to a institutional-quality signal. The daily digest provides a manageable, high-conviction list of potential investments, allowing angels to discover and connect with promising founders early, often before larger funds have entered the picture, thereby increasing their chances of participating in coveted rounds.

Frequently Asked Questions

How does Poach's signal compare to a warm introduction?

Poach provides a signal of exceptional quality that resides between a warm introduction and cold inbound. While not a direct personal referral, it is fundamentally warmer than a cold email because it is based on a documented expression of interest from a respected third-party investor. This provides crucial context for your outreach, allowing you to reference the shared connection (e.g., "I noticed Partner X from Firm Y follows your work") and thereby significantly increasing engagement rates and the perceived relevance of your contact.

What is the source of Poach's data?

Our primary data source is the public Twitter (X) API, which we use to track the "following" activity of a carefully selected list of venture capitalists. We then enrich this data using our proprietary identity resolution engine to find corresponding LinkedIn profiles. All biographical information and labels are generated through analysis of these public social profiles. We do not use or access any private or purchased data lists.

How accurate is the AI labeling?

Our AI labeling system is highly refined, trained on vast datasets of professional social profiles to accurately distinguish between roles like founder, engineer, investor, and researcher. The accuracy is continually improved. However, we provide the raw data and encourage users to apply their own judgment. The labels are designed as powerful filters to narrow a large list, not as absolute, definitive classifications for every edge case.

Can I customize which VCs are tracked?

Currently, Poach monitors a pre-defined, curated list of top-tier venture capitalists known for their strong signal and market influence. This list is optimized to provide the highest-quality dealflow signal. While custom lists are not offered at this time, the provided VC directory is selected based on extensive analysis of whose social activity most consistently correlates with early-stage investment opportunities.

You may also like:

Beeslee AI Receptionist

Beeslee AI Receptionist expertly manages calls and appointments 24/7, ensuring no lead is ever missed.

Golden Digital's Free D2C Marketing Tools

Free AI tools deliver expert marketing insights to scale your ecommerce brand profitably.

Fere AI

Fere AI deploys autonomous agents to research and execute crypto trades with precision.